Know everything about e-Invoice:

The CBIC (Central Board of Indirect Taxes and Customs) has issued a notification that e-Invoicing is to be mandatorily accepted by all companies or suppliers with a turnover exceeding Rs 500 crore. Before the limit for preparing e-Invoice was 100 Crores. This new change in a system or law is the gateway for the digitization of business processes in India. The provisions will come into effect from 1st October 2020.

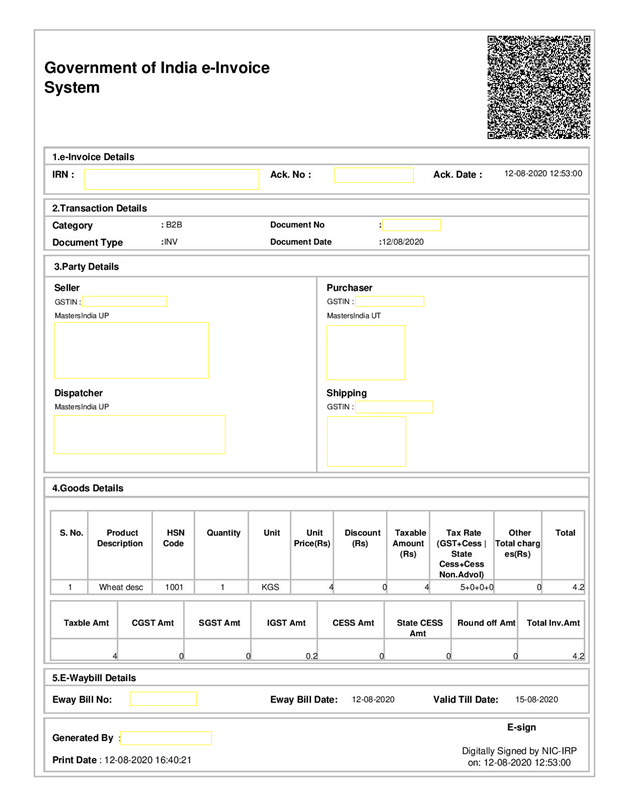

The CBIC has modified the e-Invoice format by adding in 20 new fields and removing 13 pre-existing ones. Also, few alterations have been made to the character length in certain fields.

What is e-Invoicing or Electronic-invoicing?

Electronic invoicing (e-Invoicing) is the exchange of the electronically generated bills document between a supplier and a buyer and validated by the government tax portal.

An e-Invoicing is the transaction processing system where B2B invoices are digitally prepared in an e-Invoicing format and authenticated by the GSTN. This system ensures that a common format is followed by all businesses before reporting invoices to the GST portal.

What are the documents covered for e-Invoicing?

The taxpayers need to be reported the following documents to the government under e-Invoicing regulation:

- Invoice by Supplier

- Credit Note by Supplier

- Debit Note by Supplier

- Any other document as required by law to be reported

Can an e-Invoice be cancelled?

An e-Invoice cannot be cancelled partially, it has to be cancelled fully. If cancelled once, need to be reported to the IRN within 24 hours. If the cancellation has been done after 24 hours, the taxpayers can manually cancel the same on the GST portal before the returns are filed.

How can an e-Invoice be amended?

All amendments to an e-Invoice can be made only on the GST Portal.

How will e-Invoicing benefit businesses?

- It resolves and plugs a major gap in data reconciliation under GST to reduce mismatch errors.

- Provides interoperability. An e-Invoices created on one software can be read by another.

- Real-time tracking of invoices

- Automation of the tax return filing process – the relevant details of the invoices would be auto-populated in the various returns, especially for generating the part-A of e-way bills. Faster availability of genuine input tax credit.

- Lesser possibility of audits or surveys by the tax authorities since the required information is available at a transaction level.

The timeline for e-Invoicing implementation in India?

The e-Invoicing was to be mandatorily implemented from 1st April 2020 but has been pushed to 1st October 2020 for taxpayers with turnover over Rs. 500 Crore.

What happens if e-Invoice is missed or delayed?

CBIC said it has been reported that even after more than nine months of the first notification in this regard, some of these taxpayers having an aggregate turnover of Rs. 500 crore and above are still not ready.

Accordingly, as the last chance, in the initial phase of implementation of e-Invoice, it has been decided that the invoices issued by such taxpayers during October 2020 without following the prescribed rule shall stand waived if the Invoice Reference Number (IRN) for such invoices is obtained from the Invoice Reference Portal (IRP) within 30 days of the date of invoice.

CBIC said that no such relaxation will be available for the invoices issued from 1st November 2020.

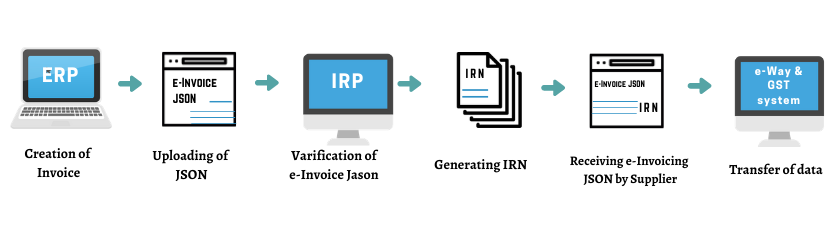

Process of the generation of e-Invoice

Nway ERP fully supports e-Invoicing for an automated digital solution without any hassle and offer different ways to connect to source ERP for invoice extraction. With Nway ERP you will get a fully integrated accounting system from Accounting to Billing to Inventory to GST, manage all your business data seamlessly.